We’re now nearly two weeks into the new financial year, and most companies that run a monthly payroll are starting to feel the first payroll of 2017/18 approaching. This can feel a little overwhelming if it’s the first time you’ve changed over financial years with changes of tax codes and ensuring you’re paying at least National Minimum Wage to your employees.

So let’s break it down into pieces and take the stress right out of the situation.

There are two considerations here, tax codes and the recent changes in minimum wage.

So, let’s consider the tax code changes first…

The standard tax code for 2016/17 was 1100L, giving a basic personal allowance of £11,000.00.

For 17/18 this has increased to £11,500.00, changing the basic tax code to 1150L. This allows an employee to earn £221.00 per week or £958.00 per month before starting to paying PAYE tax on their earnings.

Any tax code that ends in L should be increased by 50 to take this increase into account.

Any tax code ending in M should increase by 55, and any tax code ending in N should increase by 45.

If you have received instruction from HMRC in the form of a P9T or an electronic data interchange notice via your software you should use this code instead.

If your employees have a tax code of BR, SBR, D0, SD0, D1, SD1 and NT these should be carried forward as they are.

Some employees may have a ‘Week 1’ or ‘Month 1’ marker attached to their payroll record. This should not be carried forward.

All the above details can be found on the HMRC issued P9X document which also gives guidance on how to process leavers before 6th April, new employees after 6th April and any employees that receive a P45 and then are due a further payment. A link to the document can be found below:

HMRC P9X – Tax codes to use from 6 April 2017

So, lets now take a look at the changes in National Minimum Wage…

From the 1st April 2017 the National Minimum Wage increased, and if you pay your employees on the last day of the month the first payroll of the new financial year is the first to be affected by this increase.

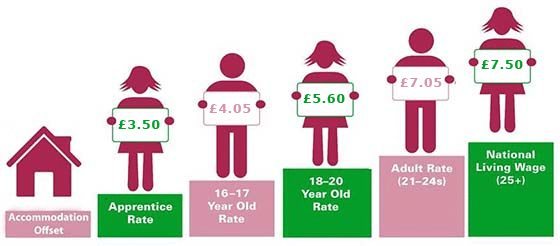

The new rates for the National Minimum wage are below:

- £7.50 per hour – 25 years old and over

- £7.05 per hour – 21-24 years old

- £5.60 per hour – 18-20 years old

- £4.05 per hour – 16-17 years old

- £3.50 for apprentices under 19 or 19 or over who are in the first year of apprenticeship

There are penalties in place for employers that fail to pay the National Living Wage to their employees. The penalty is calculated at 200% of the amount owed, unless the arrears are paid to the employee within 14 days.

The penalty is capped at £20,000.00 per employee. But an employer that fails to pay will be banned from being an Director for up to 15 years.

Further information about the National Minimum Wage can be found on the ACAS website by following the link below:

ACAS – National Minimum Wage and National Living Wage

We’re not just here for clients, we’re here to help you if you’ve got a question, have an enquiry for just need to pick someone’s brain. Call the office today on 01384 92 90 20 for a free 5 minute chat on anything payroll related. We’d love to hear from you