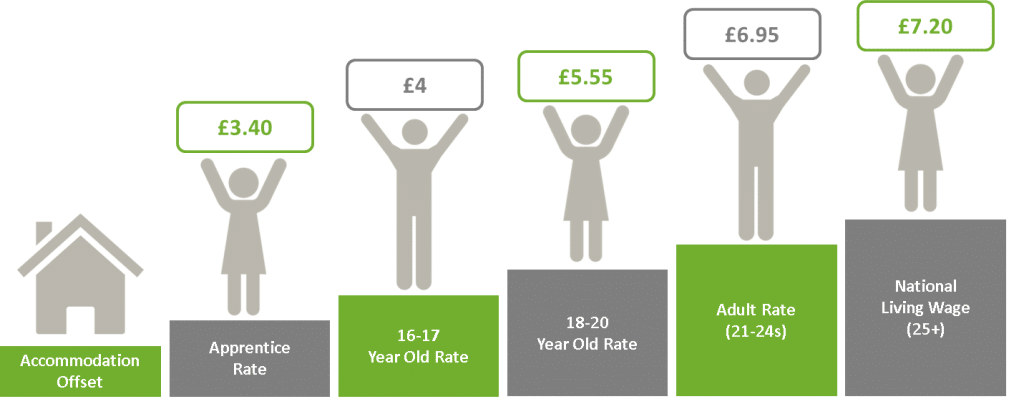

From 1st April 2016 the Government’s new National Living Wage becomes law. This means that any employee aged 25 and over is entitled to a minimum wage of £7.20 per hour. As an employer it is your responsibility to ensure that you are paying your staff correctly.

The National Living Wage must be paid to all employees aged 25 and over, including:

- part-time

- casual labourers, eg someone hired for one day

- agency workers

- workers and homeworkers paid by the number of items they make

- apprentices

- trainees, workers on probation

- disabled workers

- agricultural workers

- foreign workers

- seafarers

- offshore workers

HMRC have the right to carry out checks at any time and see your employer records. If they show that you are not paying the correct rates you will be required to pay the arrears immediately, and a penalty will be charged.

More information about the National Living Wage can be found on the Gov.org website:

https://www.livingwage.gov.uk/

PayrollAbility ensures that they are up to date with pay legislation, with annual update training with their governing body, the CIPP. This ensures that you are compliant with all payroll requirements as changes are made. Call today to discuss how we can help you stay compliant.