The Hidden Costs of Becoming an Employer

Starting a new business, and getting to the point that you need help and are looking for your first employee is exciting, and scary all at the same time. Working with small businesses as they become first-time employers, I’ve seen a few business owners be surprised by the extra costs that arise from being an employer, and so I’m going to go through them here.

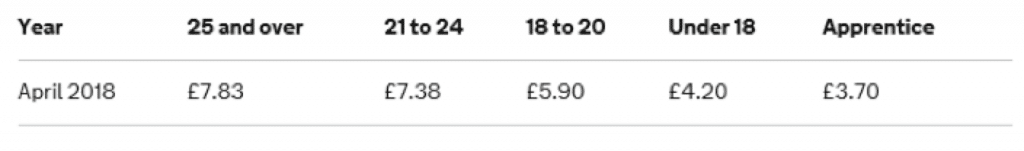

You’re going to pay your employee, and you have to pay minimum wage. The 2018/19 minimum wage rates are as below:

So if an employee is 26 years old, and works 37.5 hours per week, the minimum you can pay them is £293.63 per week, or £15,268.50 per year.

When payroll is processed the employee will have PAYE tax and national insurance deducted from their pay, and whilst that’s not an additional cost to you, you will have to pay the deductions over to HMRC at the appropriate time after the payroll has been completed.

Continuing the example above, if the employee is earning more than the £10,000.00 threshold, you will be required to have a pension scheme in place, and to auto enrol them into it. You can set up your own pension scheme, but if you’ve enlisted the help of a payroll company to run payroll for you, they will probably offer to set up the pension scheme for you. This should be a one-off fee, but the cost for this service can vary wildly. So this may be your first unexpected cost.

The employee will have a pension contribution deduction from their pay at the appropriate percentage, and this will have to be paid over to the pension company each month.

So we’ve reached the point of you having a payroll provider who charges you for running payroll each month, has charged a fee for set-up of your pension scheme, and you’ve got your employee in and working. You’re compliant, and paying your employee legally. Everyone’s happy. Yes? Well, maybe, but…

Here’s where the other costs that you may not be aware of pop up.

As an employer, you have the additional cost of Employers NI. This is paid to HMRC in addition to the employers NI, and is an additional cost that every business has to bear. It’s calculated for each employee individually, and for 2018/19 is paid on earnings over £162.01 per week or £702.01 per month. Employers NI is calculated at a rate of 13.8%. So continuing our example, for an employee that is paid £293.63 per week, you will pay £18.16 per week, or £944.58 per year in employers NI. And it doesn’t stop there!

Lets go back to that pension scheme you’ve got, and take another look at that.

Employers are also required to contribute to their employees’ pension. An employee must be enrolled into a auto enrolment compliant pension scheme. In 2018/19 the total contribution made to the scheme must be 5% of earnings, and the employee contributes 3% of that from their earnings. The employer is required to contribute a minimum of 2% in addition to the 3% contributed by the employee.

The minimum compliant contribution can be calculated on what are called Qualifying Earnings. The qualifying earnings band in 2018/19 are earnings between £116.00 and £892.00 per week. So continuing our example, at 2% an employer will be required to contribute £3.55 per week, or £184.74 per year. The contribution rates are increasing in in 2019/20 to 8%, of which 3% must be contributed by the employer. Considering that the minimum wage may also increase, the contribution will be in excess of £277.00 per year.

Those unexpected costs total up quite quickly, but that’s most of the doom and gloom out of the way. Let’s find some good news.

HMRC grant qualifying employers a benefit called Employers Allowance. This is relief on the first £3,000.00 of Employers NI payable in the financial year. If you are entitled to this, your payroll provider should claim this for you, and based on our example, you could have 3 full time, minimum wage employees and be just under the threshold of £3,000.00.

But should your business grow, and you use your allowance early on in the financial year, you’ll be required to pay Employers NI to HMRC each quarter or month.

The last consideration is Statutory Sick Pay. Employees that become ill are entitled to SSP. This is a payment of £92.05 per week that employers have to pay to qualifying employees during sickness absence. This used to be a payment that employers could claim back from HMRC, but since the introduction of Employers Allowance, SSP can no longer be claimed back.

According to a business article published by the BBC, whilst sickness absence in the UK is at an all-time low, the average employee takes 4.3 days sickness per year. Depending on the way that sickness happens, you may be required to pay sickness absence which, depending on your employees working pattern, could cost you up to £92.05.

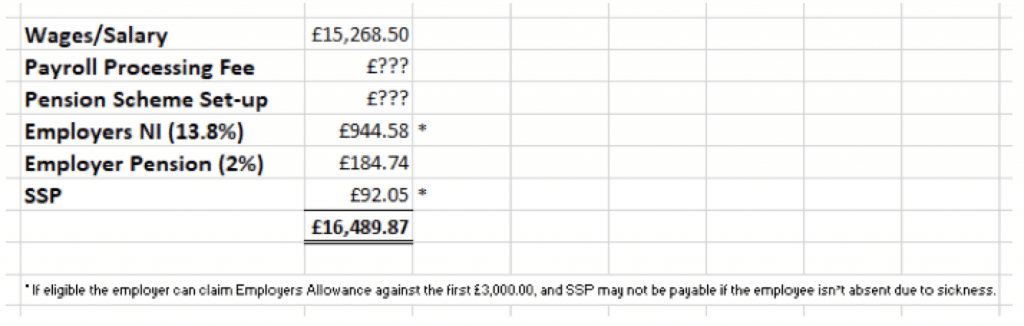

We’ve gone through the basics of what you’ll encounter in additional costs as a small employer. A quick summary of the annual cost of your first employee might look something like this:

One final thought is Holiday Pay. Each employee is entitled to 5.6 weeks holiday each year, including the 8 statutory holiday days. If your employee is part-time, they are still entitled to holiday at a pro-rata’d rate. If your employee works different hours each week, you can calculate their holiday by working out 12.07% of the total hours worked. Many small businesses can find themselves surprised by the cost of holiday hours accrued if an employee leaves without taking holiday. An employee working full time will accrue 19.61 hours or 19 hours and 37 minutes in a full working month, which has a monetary value of £153.55 at minimum wage. So whilst it’s part of the wages/salary figure in our example, it’s always a good idea to keep your eye on the holiday entitlement your employees have accrued.

There are a couple of costs in the example that we don’t have figures for. That’s the cost of getting a payroll provider to run payroll for you, and setting up that pension scheme. So lets add those figures in.

PayrollAbility’s payroll processing starts at £17.50 per month, with no added extras or nasty hidden costs. The whole process of running payroll, providing you or your accountant with reports and your employee with a payslip, and submitting your payroll to HMRC along with managing your pension scheme each month is included in the monthly fee. There’s no admin fee for adding new starters or taking leavers off the payroll, and they’ll get their P45 as part of the cost. Holiday is monitored and we’ll give you a report each month with the hours accrued by each employee.

And the pension scheme has a fixed price set-up of £189.00*

So rather than stressing about the cost of payroll, call the office today and speak to Nadine about help and support with costing your new employees. We can take to worry out of growing your business, giving you the time back to do what you do best.

We’re looking forward to speaking to you soon.