PayrollAbility Blog

Payroll topics in detail – Help and support as you need it

Paying PAYE Deductions to HMRC

Whether you’re running your own payroll, already have your payroll outsourced with another provider, or plan to outsource your new business payroll to PayrollAbility, the one job that you’ll still have to do each month or quarter is to pay the deductions made to your...

Adoption Pay and Leave

These days it’s common knowledge that there is a structure to support mothers with Maternity Pay and Leave, however employees adopting a child are also entitled to Adoption Pay and Leave. Let’s take a look at how Adoption Pay and Leave works… Employees either adopting...

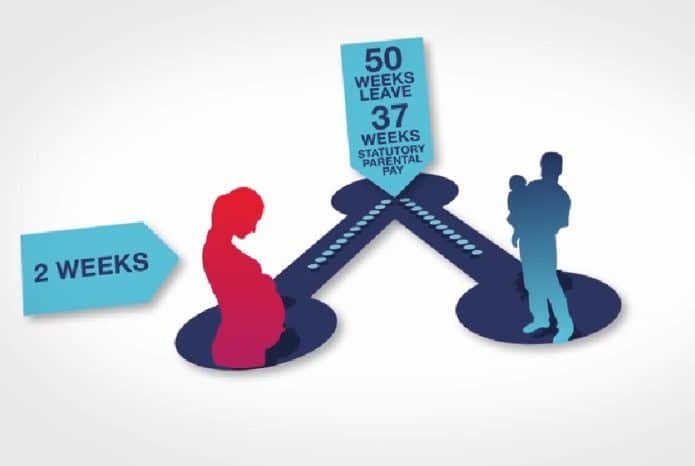

Shared Paternity Leave and Pay

Shared Paternity Leave and Pay gives new parents and adoptive parents the opportunity to share the Maternity Leave and Pay that an eligible woman is entitled to. This gives the opportunity for a new father or partner of the mother to get to know their new baby in the...

Statutory Paternity Pay and Leave

When a baby is expected, a working mother is aware of the Maternity Leave and Pay that she can expect her employer to provide, but in many cases Shared Paternity Leave is still not taken up by working father or partner. An article in the Guardian in April 2016 stated...

Payroll for 2017/18 – Making Changes and Starting the Year Off Correctly

We’re now nearly two weeks into the new financial year, and most companies that run a monthly payroll are starting to feel the first payroll of 2017/18 approaching. This can feel a little overwhelming if it’s the first time you’ve changed over financial years with...

Outsourcing Payroll – How Difficult is it to do? And How WE Make It Even Easier!

If you’ve considered outsourcing your payroll, or changing provider, one of the things on your mind is probably how much effort you’re going to have to put into the initial task of getting all the information to the new outsourcing company. You’ve likely wondered how...

Payroll Year End for 2016-17 – Getting It Right.

So, the 5th of April looms and for people like me (and those running their own payroll) that means one thing. PAYE Year End! In previous years, there would have been a mad scramble to ensure clients complete the required declaration for PAYE year end, and to get it...

NOW: Pensions – An Overview

Many small employers are rapidly approaching their auto enrolment staging date, and feel overwhelmed by their responsibilities as an employer. The big question is ‘How do I choose a pension provider without paying a pension advisor a small fortune?’ To begin to answer...

The People’s Pension – An Overview

Many small employers are rapidly approaching their auto enrolment staging date, and feel overwhelmed by their responsibilities as an employer. The big question is ‘How do I choose a pension provider without paying a pension advisor a small fortune?’ To begin to answer...

Nest Pensions – An Overview

Many small employers are rapidly approaching their auto enrolment staging date, and feel overwhelmed by their responsibilities as an employer. The big question is: ‘How do I choose a pension provider without paying a pension advisor a small fortune?’ To begin to...

Payrolling Benefits in Kind – An Overview

Many employers will incorporate benefits into an employee’s remuneration package. Things like private medical insurance and company car and fuel are common examples. From 6th April 2016 HMRC introduced payrolling of benefits in kind (PBIK) which allows HMRC to collect...

The Start of my YouTube Video Adventure and SEO – Part 1

Over the last 3 months or so it’s become startlingly clear to me how much of a dramatic impact YouTube Video can have on the SEO of a website. Whilst I’m now actively seeking out info on video and how to optimise it for SEO, there was a period of time that this stuff...

Follow us on social media

36 Cavendish House

Kings Road

Brighton

BN1 2JH