This is part of a series of 3 ‘Back to Basics’ blogs to help employers talk to their employees about payroll, and to answer their initial questions about how their pay has been calculated. This blog focuses on pensions and auto enrolment.

Auto enrolment came into force on 01st October 2012. Initially only large employers were required to provide an auto enrolment compliant pension scheme for their employees, however this was rolled out to all employers over the following years. It is now the responsibility of all employers to provide a pension scheme for employees. This includes companies with only one employee, and people who employ others in their homes for personal care and support.

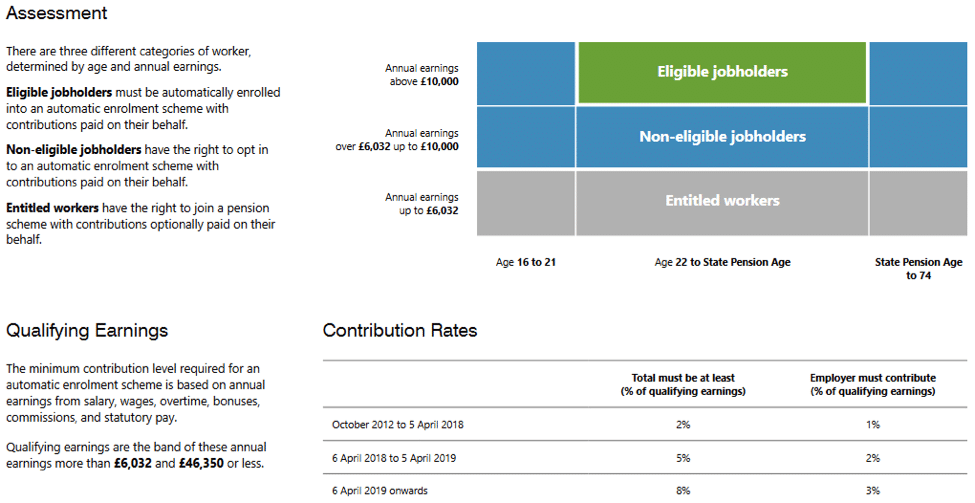

In 2018-19, any employee aged from 22 to state pension age, earning over £10,000.00 per year must be auto enrolled into a compliant pension scheme, and a 3% contribution is deducted on earnings over £502.00 per month. The employer is required to make a 2% contribution to the employees pension scheme, bringing the contribution up to 5% in total. These employee are called ‘Eligible Jobholders’

In 2019-20 the age and thresholds remain the same, however the contribution will increase to 8%, with the employee paying 5% and the employer paying 3%.

The employee has the right to opt out of the pension scheme, and does this by contacting the pension scheme directly to advise their decision. They cannot opt-out by telling the employer.

Every 3 years any employee who has opted out will be reassessed and opted back into the pension scheme, and will have to opt out again if they do not want to begin to make contributions.

Employees aged 21 and under, or those earning less than £10,000.00 fall into other categories, being called either ‘Non-eligible Jobholders’ or ‘Entitled Workers’. A Non-eligible Jobholder has the right to opt-in to the pension scheme, and the employer is required to contribute to the scheme at the minimum required percentage. Entitled Workers have the right to opt-in, however the employer is not required to contribute to the scheme unless the workers status changes.

The table below sets out an easy way of determining your workers status when assessed, and each worker should be assessed each pay period.

More information can be found on the Pensions Regulator website by following the link below:

https://www.thepensionsregulator.gov.uk/en

HMRC also provide information relating to workplace pensions on the Gov.UK website which can be found by following the link below:

https://www.gov.uk/workplace-pensions

If you’d rather have a chat about pensions, you can call Nadine at PayrollAbility on 01273 56 92 27. We’re happy to help and look forward to speaking to you.